In international trade, especially for sanitary ware, understanding the HS Code is key. This code helps to identify products globally for customs and set tariffs. Our guide explains it for different sanitary ware items and gives a table for easy reference. We also show how to find the right HS Codes, use them for tax benefits, and avoid risks of wrong codes. This will help you smoothly handle international trading.

Understanding Harmonized System (HS) Code

In global trade, the Harmonized System (HS) Code is a critical tool. It’s a unique numerical code assigned to products to standardize their identification worldwide. This system, established by the World Customs Organization in 1988, is now used by over 200 countries and covers 98% of goods in international commerce.

HS Codes are essential for classifying products during import and export, determining tariffs, and ensuring compliance with international trade laws. For instance, in the sanitary ware industry, each item, be it a toilet or a sink, has a specific code that influences its tax rate and customs treatment.

In essence, HS Codes simplify global trading by providing a common language for products, thereby facilitating efficient and compliant international transactions. Understanding these codes is vital for businesses engaged in international trade, as it directly impacts the import and export processes.

HS Code Classification For Various Sanitary Ware Products

In the sanitary ware industry, each product type is classified under a specific code based on its material and function. Here’s a detailed table demonstrating the HS Code classifications for various sanitary ware products, including ceramic sanitary ware, plastic sanitary ware, and stainless steel sanitary ware:

| Product Type | Material | HS Code | Description |

| Ceramic Basins | Porcelain/Ceramic | 691010 | Includes washbasins and pedestals of ceramic. |

| Ceramic Toilets | Porcelain/Ceramic | 691010 | Comprises one-piece and two-piece toilets. |

| Ceramic Bidets | Porcelain/Ceramic | 691010 | Ceramic bidets for bathroom installations. |

| Plastic Bathtubs | Acrylic/Plastic | 392210 | Acrylic bathtubs and shower trays. |

| Shower Enclosures | Glass/Aluminum | 761010 | Glass and aluminum structured shower rooms. |

| Stainless Steel Sinks | Stainless Steel | 732490 | Kitchen and bathroom sinks made of stainless steel. |

| Faucets | Brass/Zinc Alloy | 848190 | Taps and valves for sinks and basins. |

| Shower Heads | Brass | 740182 | Shower heads and related shower fittings. |

| Bathroom Accessories | Brass/Stainless Steel | 741820/732490 | Towel racks, toilet paper holders, soap dishes. |

Steps To Find The Correct HS Codes For Sanitary Ware

Here’s a simplified guide to help you find the right HS Codes for your sanitary ware products:

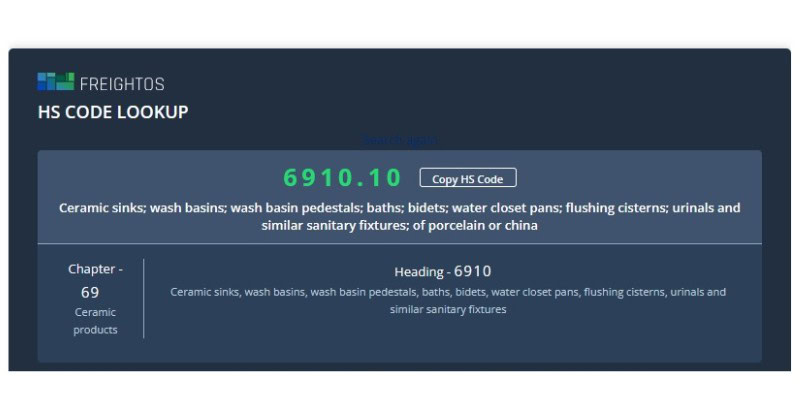

- Use Online Tools: Enter ‘ceramic sinks‘ in an online finder like Freightos HS Code Lookup to get potential code. Or websites like the World Customs Organization(WCO) and local customs websites, simply enter a detailed description of your product to find the corresponding code.

- Ask the Seller: If you’re importing ceramic sinks from a manufacturer, ask them to provide the code they use for exports.

- Talk to Shipping agent: Consult with your freight forwarder about the HS Code of sanitary ware fittings you plan to ship.

- Check Tariff Book: Look up the tariff book of your country for ‘ceramic basins’ to find the specific code, like 691010 for porcelain basins.

- Keep Up-to-Date: Regularly check trade websites for any updates, especially if you frequently deal with newly developed sanitary ware products.

Using HS Codes For Preferential Tax Benefits

Making the most of HS Codes for tax benefits involves a few specific steps. Here’s a more detailed guide:

- Find Out Tax Rates. First, identify the exact tariff rates associated with your sanitary ware products by referring to their HS Codes. Each product type, such as ceramic basins or brass faucets, has a different code and, therefore, different tariff implications.

- Check for Special Trade Deals. Countries often have trade agreements that provide lower tariffs for certain products based on their HS Codes. Check if your products’ codes are covered under any such agreements between your country and your trading partner countries.

- Use the Right HS Code. Ensure that each sanitary ware item is classified correctly under its appropriate HS Code. Misclassification can lead to missing out on potential tax benefits.

- Get Advice from Experts. To navigate the complexities of trade laws and tariffs, consider seeking advice from customs brokers or trade experts. They can provide insights specific to the sanitary ware industry and help ensure that you’re leveraging them effectively for tax benefits.

- Keep Good Paperwork. Keep thorough documentation that substantiates your use of specific codes. This is important for customs verification and to defend your tax benefit claims if audited.

By doing these things, you can use HS Codes to potentially cut down on taxes when trading internationally. This can make things cheaper for your business and help you compete better.

The Risks of Incorrect HS Code Declarations And How to Avoid Them

Using the wrong HS Code can lead to several problems in international trade. Here’s what you need to know about the risks and how to avoid them:

- Customs Delays: The wrong code can cause delays at customs. This means your products might get held up, leading to late deliveries and unhappy customers.

- Higher Tariffs and Fines: If the incorrect code has higher tariffs, you might end up paying more tax. Also, customs authorities might fine you for the wrong declaration.

- Legal Issues: Serious cases of misclassification, especially if seen as intentional, can lead to legal problems or being flagged as a risky trader by customs authorities.

Here’s how to avoid these problems:

- Double-Check HS Codes: Always double-check for each product. Look at detailed descriptions to make sure they match your products.

- Stay Updated: HS Codes can change. Make sure you’re using the latest codes by regularly checking official customs or trade websites.

- Train Your Team: Ensure that your team is well-trained in classifying products and understanding these specific codes.

- Consult Experts: When in doubt, consult with customs brokers or trade compliance experts. They can help you get the classification right.

By following these steps, you can reduce the risk of issues with customs and keep your international trade running smoothly.

Conclusion

In conclusion, mastering the use of HS Codes is crucial in the sanitary ware industry for smooth international trading. This guide has provided you with essential knowledge on HS Code classifications for various sanitary ware products, along with practical steps to find and use these codes effectively. By leveraging these specific codes, you can enjoy tax benefits, avoid customs delays, and ensure compliance with global trade regulations. Remember, accurate HS Code declarations are key to avoiding legal issues and maintaining a smooth flow in your international business operations.